All Categories

Featured

Table of Contents

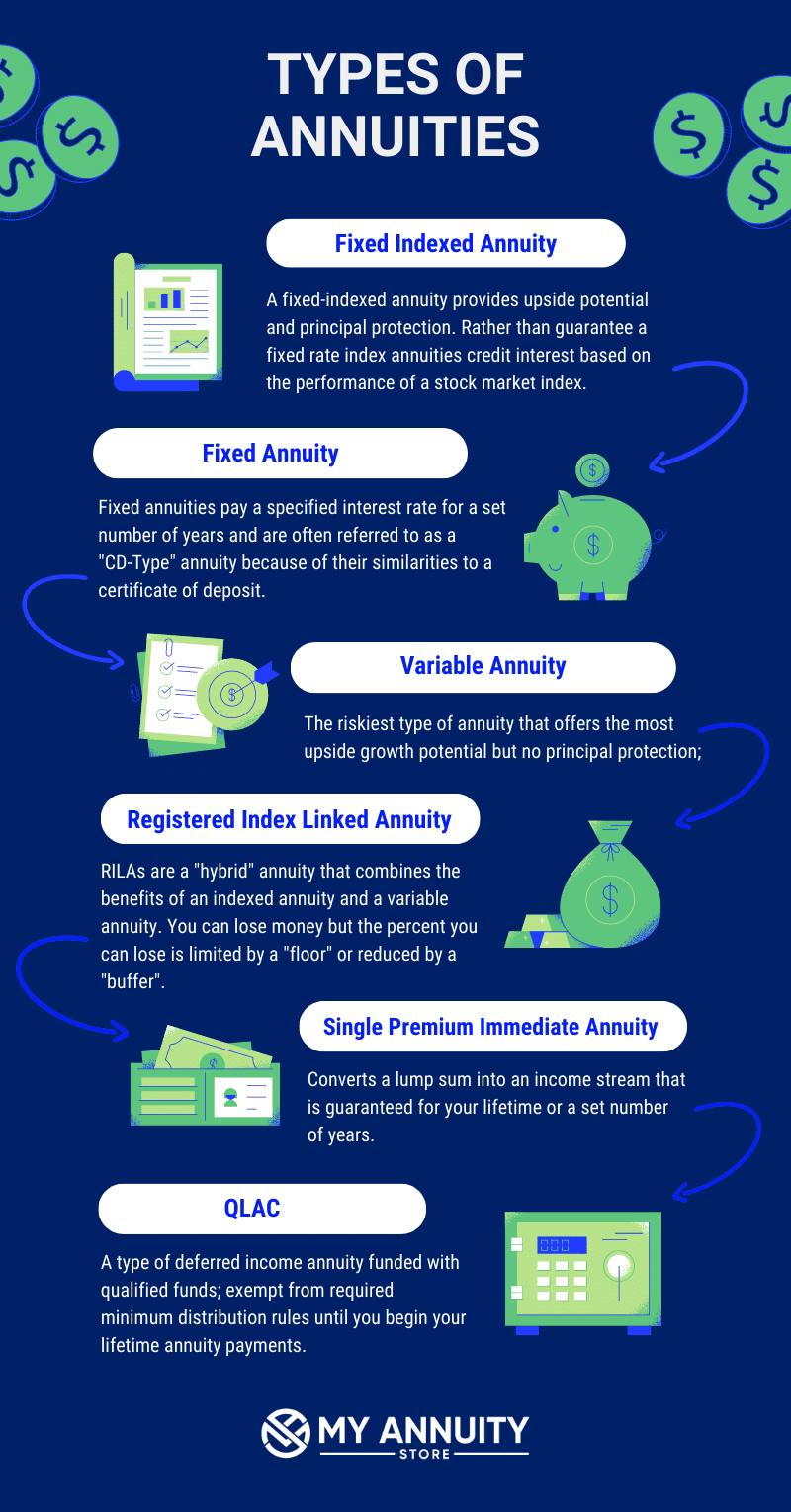

There are three types of annuities: repaired, variable and indexed. With a dealt with annuity, the insurance provider assures both the price of return (the rate of interest) and the payout to the financier. The passion price on a taken care of annuity can transform gradually. Often the rates of interest is dealt with for a variety of years and afterwards adjustments occasionally based upon current rates.

With a deferred set annuity, the insurance provider consents to pay you no less than a defined interest rate as your account is expanding. With an instant fixed annuityor when you "annuitize" your deferred annuityyou obtain an established fixed quantity of cash, normally on a regular monthly basis (similar to a pension).

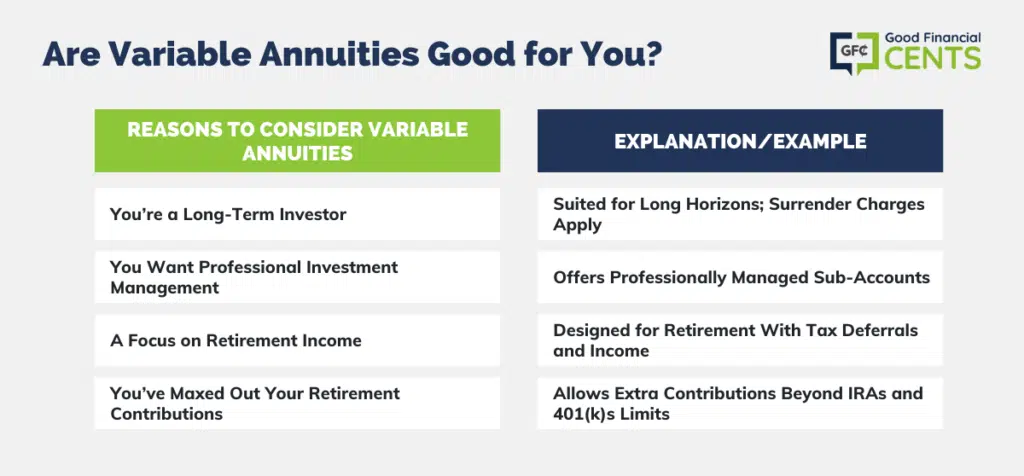

While a variable annuity has the benefit of tax-deferred development, its annual expenditures are most likely to be a lot more than the expenditures of a normal shared fund. And, unlike a repaired annuity, variable annuities don't offer any type of guarantee that you'll gain a return on your financial investment. Instead, there's a danger that you might in fact shed money.

Breaking Down Your Investment Choices A Comprehensive Guide to Fixed Income Annuity Vs Variable Annuity What Is the Best Retirement Option? Advantages and Disadvantages of Different Retirement Plans Why Choosing the Right Financial Strategy Is Worth Considering Variable Annuity Vs Fixed Annuity: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Rewards of Long-Term Investments Who Should Consider Fixed Vs Variable Annuity Pros Cons? Tips for Choosing the Best Investment Strategy FAQs About Immediate Fixed Annuity Vs Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Annuities Variable Vs Fixed A Beginner’s Guide to Annuities Variable Vs Fixed A Closer Look at Deferred Annuity Vs Variable Annuity

As a result of the complexity of variable annuities, they're a leading resource of investor complaints to FINRA. Prior to buying a variable annuity, meticulously reviewed the annuity's syllabus, and ask the person offering the annuity to explain every one of the product's functions, bikers, expenses and restrictions. You should likewise understand how your broker is being compensated, consisting of whether they're getting a commission and, if so, just how much.

Indexed annuities are complex financial tools that have attributes of both fixed and variable annuities. Indexed annuities generally offer a minimum surefire passion price combined with a rate of interest linked to a market index. Numerous indexed annuities are linked to wide, popular indexes like the S&P 500 Index. Yet some use various other indexes, including those that represent other sections of the market.

Understanding the features of an indexed annuity can be complex. There are numerous indexing approaches firms utilize to determine gains and, as a result of the range and intricacy of the techniques made use of to credit rating interest, it's challenging to contrast one indexed annuity to another. Indexed annuities are normally categorized as one of the following 2 types: EIAs offer a guaranteed minimum rate of interest (usually at the very least 87.5 percent of the premium paid at 1 to 3 percent interest), in addition to an additional rate of interest connected to the efficiency of one or more market index.

With variable annuities, you can spend in a selection of safeties consisting of stock and bond funds. Stock market performance establishes the annuity's worth and the return you will obtain from the money you spend.

Comfy with changes in the securities market and desire your financial investments to equal rising cost of living over an extended period of time. Youthful and want to prepare monetarily for retired life by gaining the gains in the supply or bond market over the long-term.

As you're developing up your retirement cost savings, there are several ways to stretch your cash. can be specifically valuable financial savings tools since they assure an income amount for either a collection period of time or for the remainder of your life. Repaired and variable annuities are 2 options that provide tax-deferred development on your contributionsthough they do it in different ways.

Exploring Immediate Fixed Annuity Vs Variable Annuity A Comprehensive Guide to Variable Annuity Vs Fixed Annuity What Is Variable Vs Fixed Annuity? Advantages and Disadvantages of What Is Variable Annuity Vs Fixed Annuity Why Choosing the Right Financial Strategy Is a Smart Choice How to Compare Different Investment Plans: How It Works Key Differences Between Indexed Annuity Vs Fixed Annuity Understanding the Key Features of Tax Benefits Of Fixed Vs Variable Annuities Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Indexed Annuity Vs Market-variable Annuity A Closer Look at Fixed Index Annuity Vs Variable Annuities

variable annuity or both as you outline out your retired life revenue strategy. A supplies a guaranteed rates of interest. It's taken into consideration a traditional product, using a modest earnings that are not linked to market efficiency. Your contract worth will certainly increase because of the accrual of assured passion profits, indicating it will not decline if the marketplace experiences losses.

An includes spent in the stock market. Your variable annuity's investment performance will impact the dimension of your nest egg. It might guarantee you'll obtain a series of payments that start when you retire and can last the remainder of your life, provided you annuitize (start taking payments). When you start taking annuity settlements, they will depend on the annuity worth during that time.

Market losses likely will result in smaller sized payouts. Any rate of interest or other gains in either type of contract are sheltered from current-year taxes; your tax responsibility will certainly come when withdrawals begin. Allow's check out the core features of these annuities so you can choose just how one or both may fit with your total retired life technique.

A set annuity's worth will certainly not decline because of market lossesit's consistent and stable. On the various other hand, variable annuity values will change with the efficiency of the subaccounts you elect as the marketplaces fluctuate. Earnings on your fixed annuity will very rely on its gotten price when bought.

On the other hand, payment on a dealt with annuity acquired when interest prices are low are most likely to pay incomes at a reduced price. If the rates of interest is assured for the length of the agreement, profits will certainly stay continuous no matter the markets or price task. A set rate does not mean that taken care of annuities are risk-free.

While you can not land on a set price with a variable annuity, you can choose to purchase traditional or aggressive funds tailored to your danger degree. Much more conventional investment options, such as temporary bond funds, can help in reducing volatility in your account. Considering that repaired annuities provide an established price, reliant upon present passion prices, they don't offer that very same versatility.

Exploring Fixed Vs Variable Annuity Everything You Need to Know About Financial Strategies Breaking Down the Basics of Variable Annuity Vs Fixed Annuity Advantages and Disadvantages of Choosing Between Fixed Annuity And Variable Annuity Why Fixed Income Annuity Vs Variable Growth Annuity Matters for Retirement Planning Fixed Vs Variable Annuity Pros And Cons: A Complete Overview Key Differences Between Fixed Income Annuity Vs Variable Annuity Understanding the Key Features of Fixed Index Annuity Vs Variable Annuity Who Should Consider What Is Variable Annuity Vs Fixed Annuity? Tips for Choosing What Is A Variable Annuity Vs A Fixed Annuity FAQs About Variable Vs Fixed Annuity Common Mistakes to Avoid When Choosing Fixed Vs Variable Annuity Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

You possibly might gain a lot more lengthy term by taking added risk with a variable annuity, but you could also shed cash. While fixed annuity agreements prevent market risk, their compromise is less growth possibility.

Investing your variable annuity in equity funds will certainly offer more possible for gains. The fees related to variable annuities might be greater than for various other annuities. Investment options, fatality benefits, and optional advantage assurances that might expand your possessions, additionally add cost. It's important to examine attributes and connected charges to make certain that you're not investing greater than you need to.

The insurance policy company may impose surrender fees, and the IRS might levy an early withdrawal tax charge. They begin at a certain percent and then decrease over time.

Annuity revenues are subject to a 10% early withdrawal tax penalty if taken before you reach age 59 unless an exemption applies. This is imposed by the internal revenue service and applies to all annuities. Both taken care of and variable annuities supply alternatives for annuitizing your balance and turning it into an ensured stream of life time earnings.

Understanding Financial Strategies Everything You Need to Know About Financial Strategies Breaking Down the Basics of Deferred Annuity Vs Variable Annuity Advantages and Disadvantages of Fixed Vs Variable Annuity Why Immediate Fixed Annuity Vs Variable Annuity Is a Smart Choice What Is Variable Annuity Vs Fixed Annuity: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Rewards of Long-Term Investments Who Should Consider Fixed Annuity Or Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Tax Benefits Of Fixed Vs Variable Annuities A Beginner’s Guide to Fixed Vs Variable Annuity Pros And Cons A Closer Look at How to Build a Retirement Plan

You might decide to make use of both fixed and variable annuities. If you're choosing one over the various other, the differences issue: A may be a better option than a variable annuity if you have a more conventional risk resistance and you seek foreseeable rate of interest and primary security. A might be a far better option if you have a higher risk resistance and desire the potential for long-term market-based growth.

Annuities are agreements offered by insurance provider that guarantee the purchaser a future payment in routine installations, usually regular monthly and often forever. There are different kinds of annuities that are made to offer different purposes. Returns can be repaired or variable, and payouts can be instant or delayed. A set annuity guarantees settlement of a set quantity for the term of the arrangement.

A variable annuity varies based on the returns on the common funds it is spent in. An instant annuity starts paying out as quickly as the purchaser makes a lump-sum settlement to the insurer.

An annuity that gives surefire revenue permanently (or past, for your beneficiary) Assures you that even if you deplete their various other possessions, you will still have some income coming in. Annuities' returns can be either repaired or variable. Each type has its benefits and drawbacks. With a repaired annuity, the insurance coverage business ensures the buyer a particular repayment at some future date.

Table of Contents

Latest Posts

Breaking Down Fixed Vs Variable Annuity Pros Cons A Comprehensive Guide to Fixed Index Annuity Vs Variable Annuity Breaking Down the Basics of Investment Plans Benefits of Choosing the Right Financial

Breaking Down Fixed Annuity Vs Variable Annuity Everything You Need to Know About Financial Strategies Breaking Down the Basics of Investment Plans Benefits of Pros And Cons Of Fixed Annuity And Varia

Decoding What Is A Variable Annuity Vs A Fixed Annuity Key Insights on Your Financial Future Defining Variable Vs Fixed Annuities Benefits of Fixed Vs Variable Annuity Why Choosing the Right Financial

More

Latest Posts